Summary

Homeowners in the U.S. saw a decrease in home equity by about $9,200 on average over the last year as the housing market cooled. Despite these losses, the average homeowner still has significant equity due to high home prices during the pandemic. Most states experienced a drop in home equity, with only 14 states seeing increases.

Key Facts

- U.S. homeowners lost an average of $9,200 in home equity over the past year.

- The average homeowner has about $307,000 in equity.

- Home prices rose greatly during the pandemic due to high demand and low inventory.

- In 2025, total homeowner equity decreased by $141.5 billion.

- Homeowners' total equity now is $17.5 trillion, a high number historically.

- Negative equity homes increased to 2% from 1.7% last year.

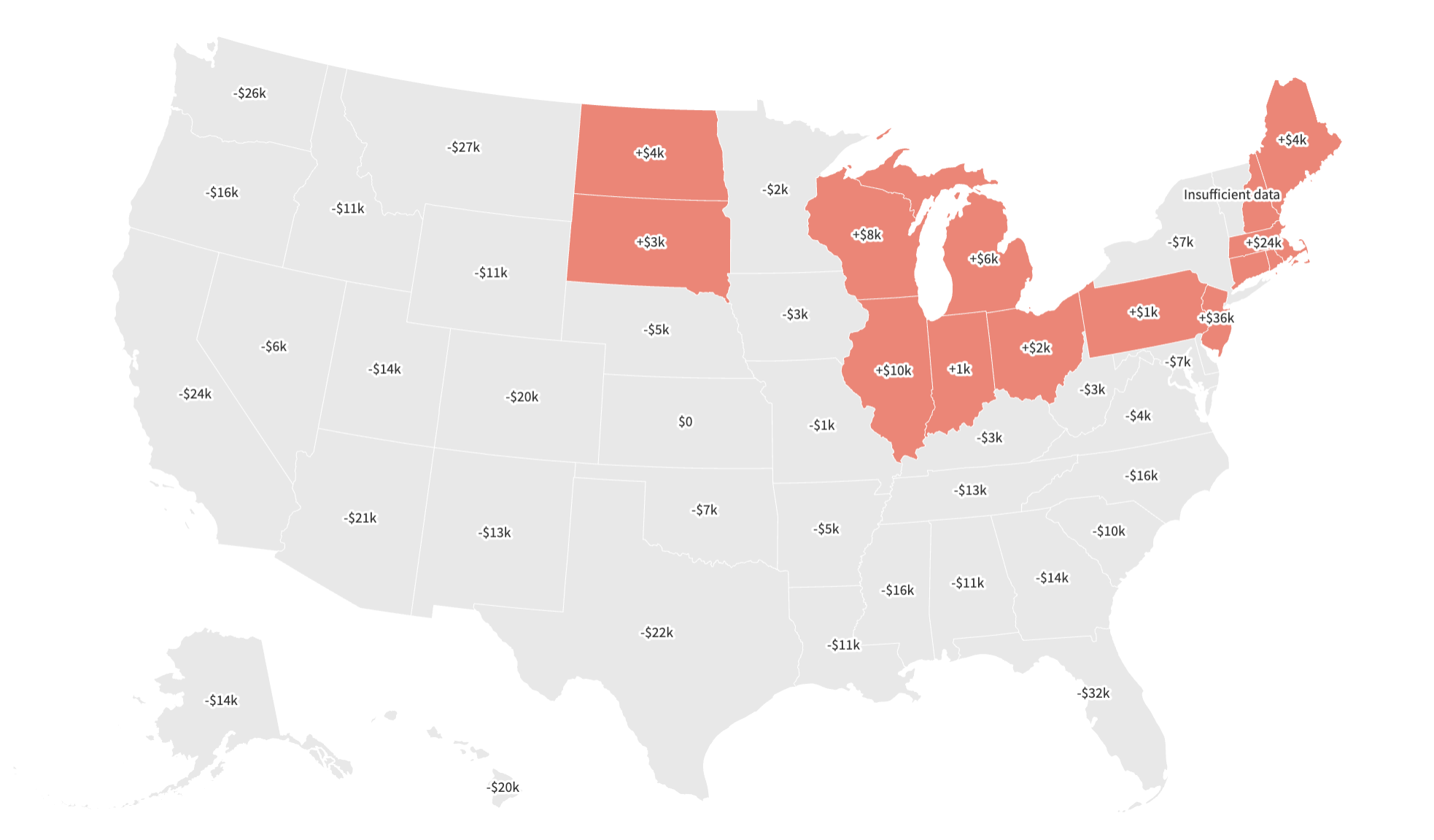

- 32 states saw a decline in home equity, while 14 states saw gains.

- The largest equity losses were in the District of Columbia, Florida, and Montana.

- Connecticut, New Jersey, and Rhode Island saw the largest equity gains.