Summary

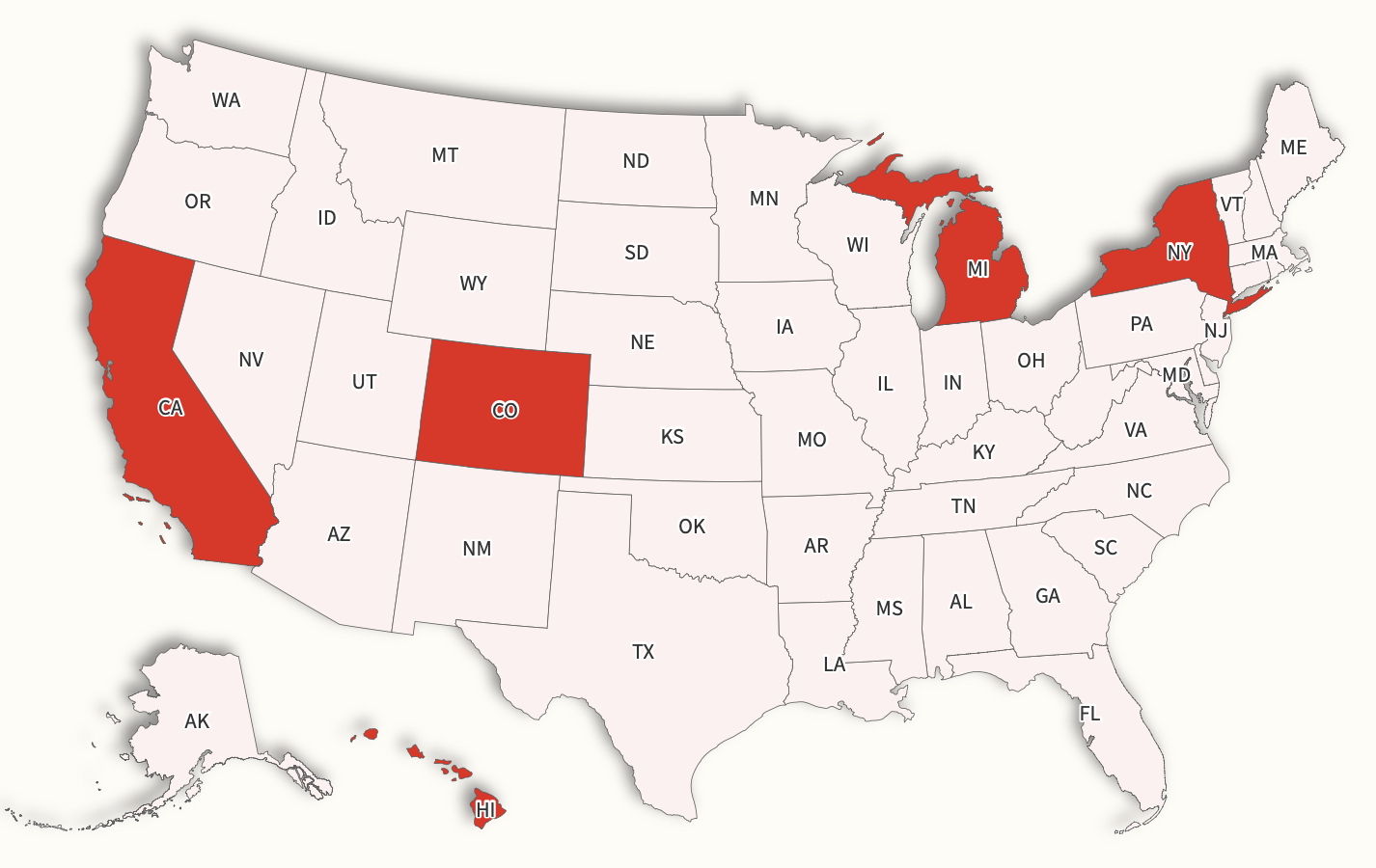

Several U.S. states are planning to adjust their tourism taxes on short-term accommodations like hotels and vacation rentals by 2026. These changes will either increase or introduce new taxes, making overnight stays more expensive for visitors. States like Michigan, Colorado, Hawaii, New York, and California are updating their policies to raise revenue for local services and infrastructure.

Key Facts

- A lodgings tax is an extra fee added to the overnight stay cost at accommodations like hotels and motels.

- Michigan may let local governments add a 3% accommodations tax if approved by local voters.

- Eagle County, Colorado, will increase its lodging tax from 2% to 4% starting January 1, 2026.

- Hawaii plans to increase its hotel room tax from 10.25% to 11%.

- Saratoga County, New York, is raising its local hotel occupancy tax from 1% to 3%.

- Menlo County and San Mateo County in California will raise their transient occupancy tax from 14.5% to 15.5%.

- San Diego, California, is increasing its hotel-room tax to fund infrastructure and homelessness services.

- Some tax changes are voted on locally, while others affect entire states.