Summary

The article discusses ongoing issues with members of the U.S. Congress not properly disclosing their stock trades. These problems involve lawmakers from both political parties, leading to potential conflicts of interest. Congress plans to review these financial disclosure failures, seeking accountability.

Key Facts

- Congresswoman Jasmine Crockett did not disclose ownership of stocks in at least 25 companies.

- Other Congress members from both parties have reportedly filed financial disclosures late or engaged in questionable stock trading.

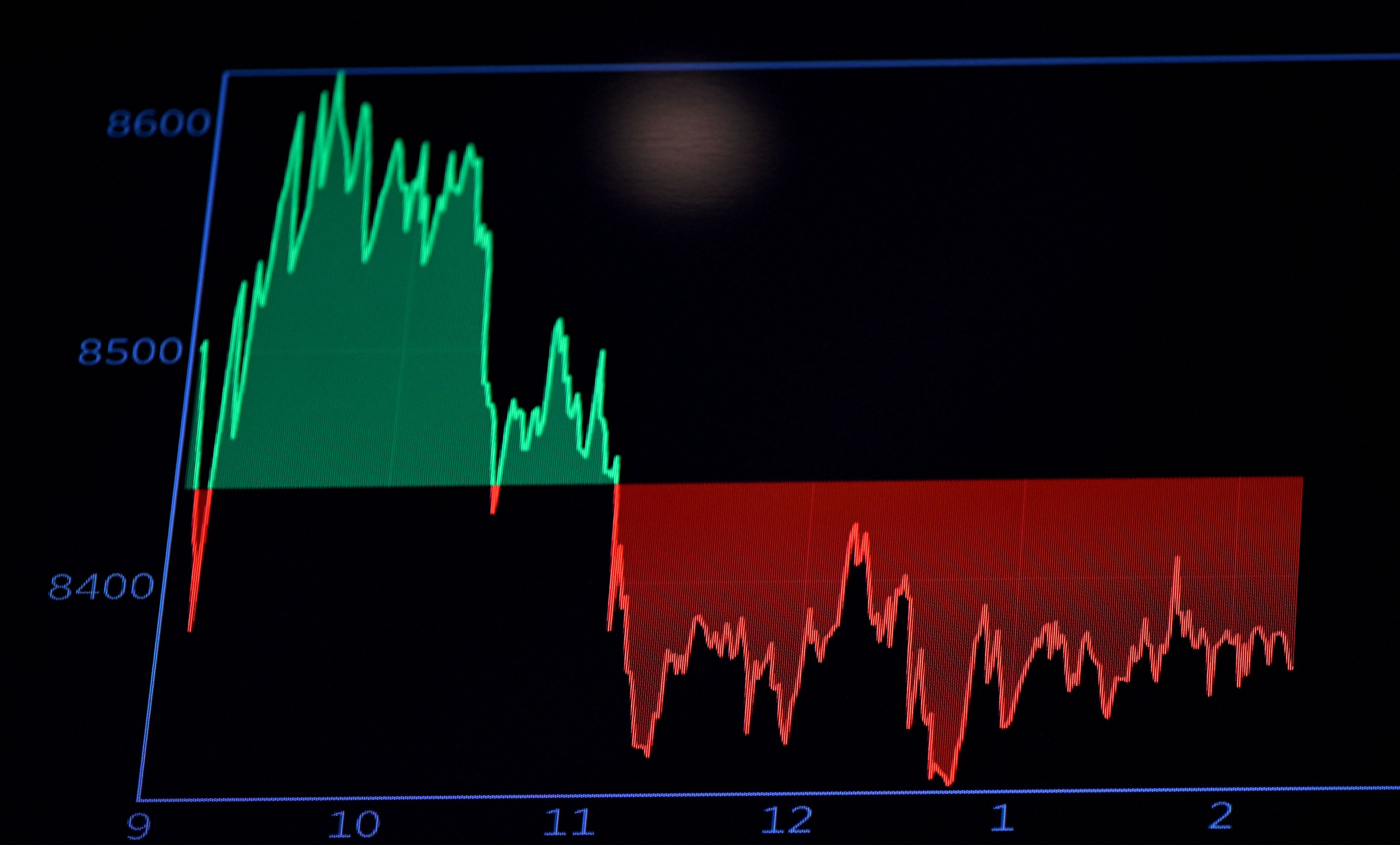

- More than 20 members reportedly gained almost double the S&P 500 average in 2024.

- Current rules for Congress members on stock trades are weaker than those for executive branch officials.

- Financial disclosures are meant to provide transparency and prevent corruption.

- Lack of proper disclosure can undermine public trust in government.

- Congress is considering actions to improve accountability in stock trading disclosures.