Summary

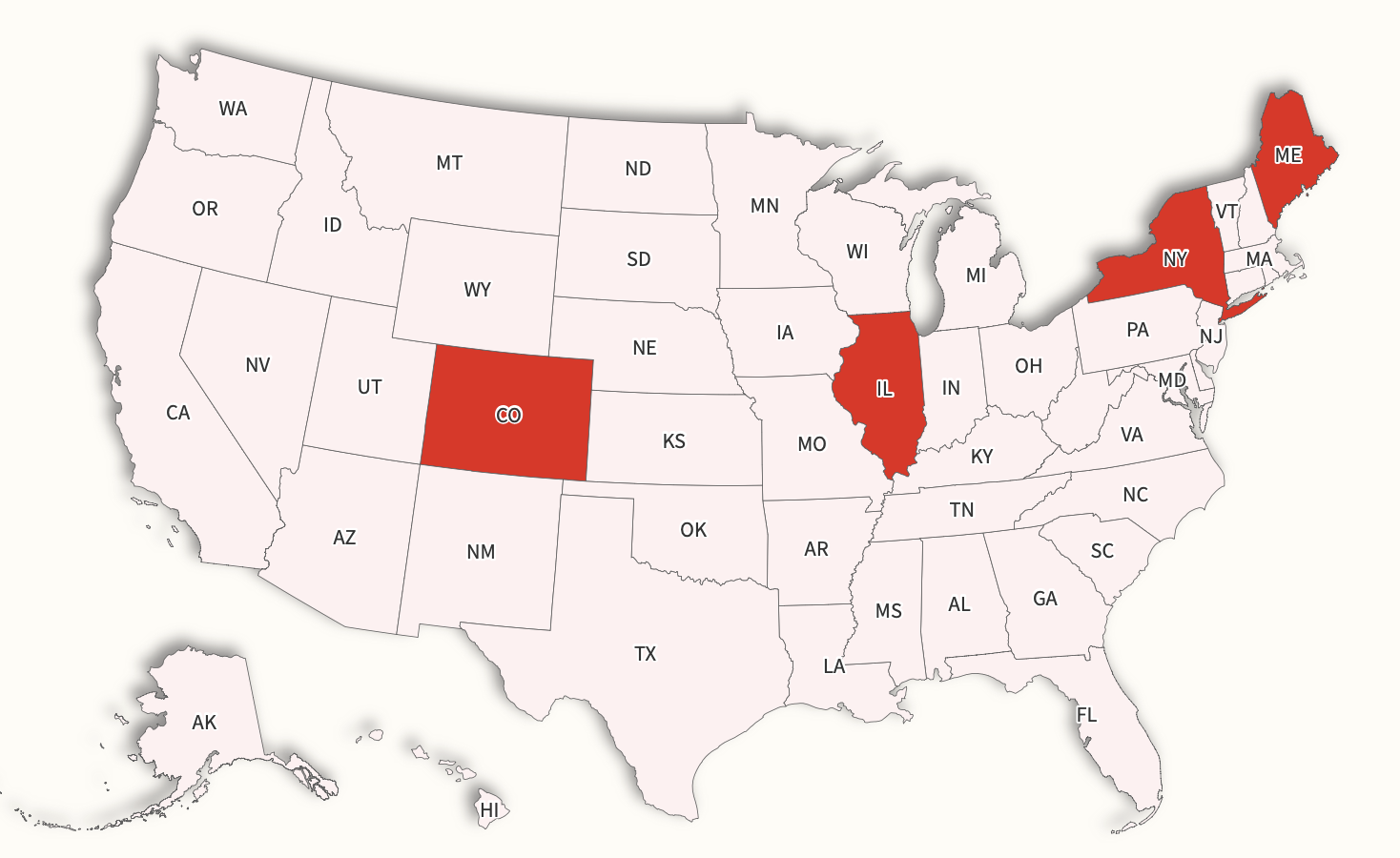

A new U.S. tax law signed on July 4 introduces federal tax deductions for seniors, service workers, and car buyers. However, these changes will not automatically apply at the state level, as some states and Washington, D.C., have decided not to adopt these tax updates. As a result, residents in certain areas will not see similar benefits on their state tax returns.

Key Facts

- The One Big Beautiful Bill Act (OBBBA) offers new federal tax deductions.

- These deductions include benefits for seniors, service workers, and car buyers.

- States have the option to adopt or reject federal tax changes.

- Washington, D.C., has temporarily blocked various federal tax provisions.

- Colorado requires taxpayers to report federally excluded overtime pay.

- New York and Illinois continue to tax tips and overtime pay.

- Maine has not accepted various OBBBA provisions, including the senior deduction and car loan interest deduction.