Summary

The IRS has released new guidance on tax deductions for tips and overtime pay. This guidance applies for the tax year 2025 and affects millions of American workers who receive tips or overtime compensation.

Key Facts

- The IRS issued guidance related to taxes on tips and overtime pay for tax year 2025.

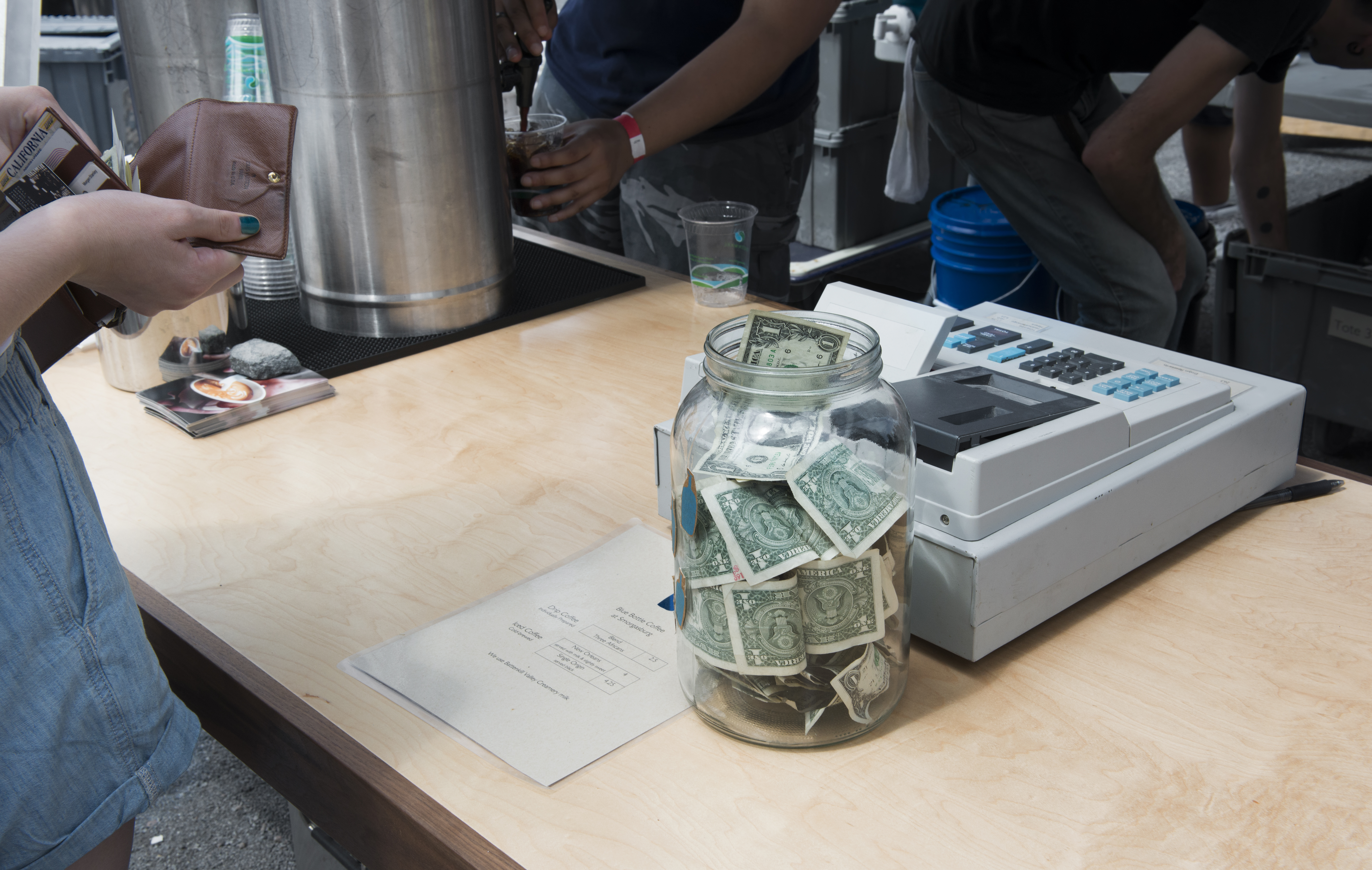

- Workers receiving tips, such as restaurant servers and bartenders, can deduct up to $25,000 per year in qualified tips.

- This tips deduction begins to phase out for individuals with an income over $150,000 or $300,000 for joint filers.

- Overtime pay deductions are available for amounts required under the Fair Labor Standards Act that exceed the regular pay rate, with a maximum deduction of $12,500 for individuals and $25,000 for joint filers.

- The income phaseout thresholds also apply to these overtime deductions.

- The IRS will update tax forms to help workers claim these new deductions.

- Employers are encouraged to provide documentation but are not penalized for lacking separate tip or overtime reporting for 2025.

- The guidance stems from provisions in the One Big Beautiful Bill Act.