Summary

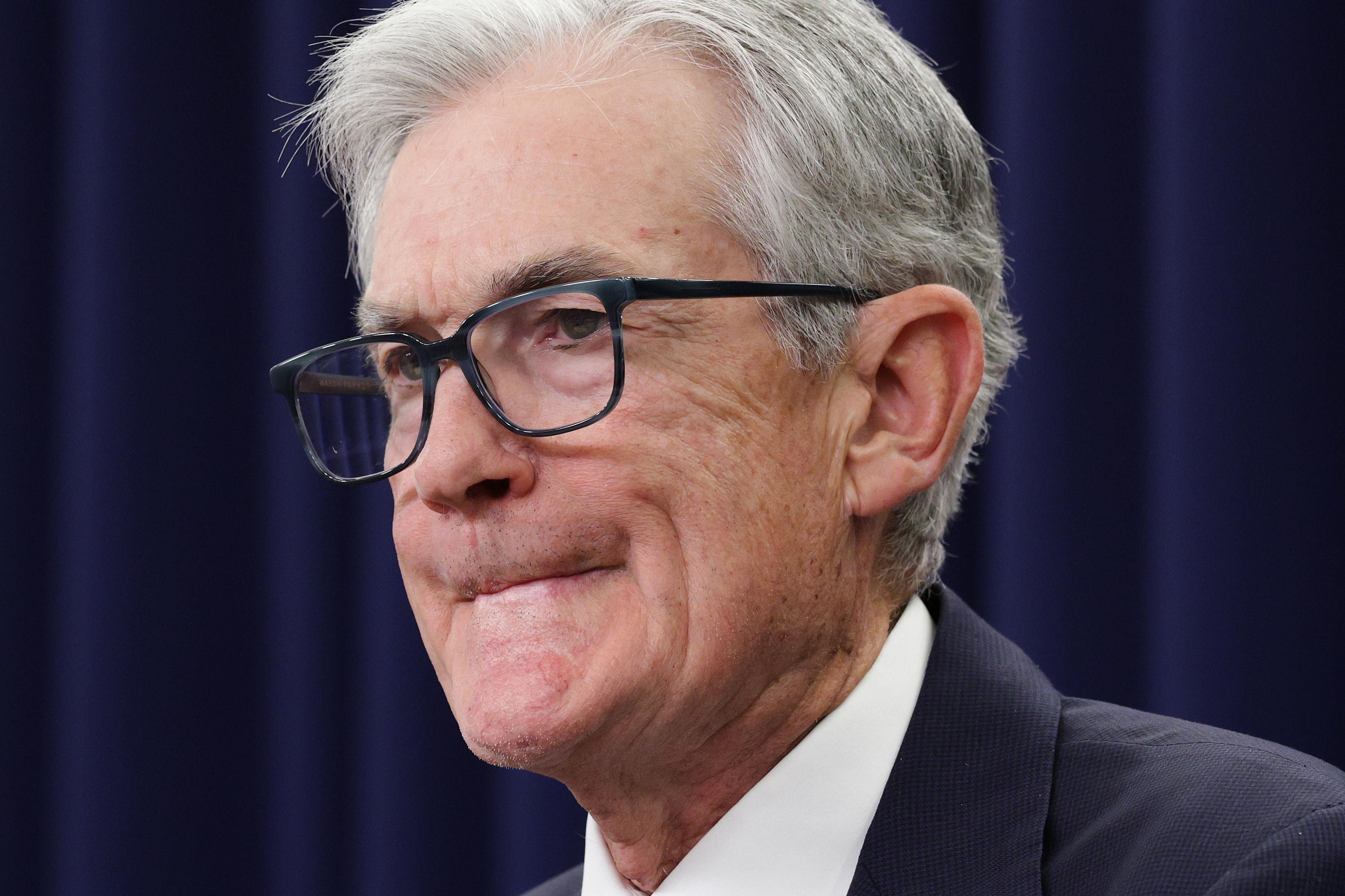

Michael Burry, an investor known for predicting the 2008 housing market crash, has raised concerns about a potential bubble in AI similar to past economic bubbles. He argues that AI-related companies are engaging in excessive spending, reminiscent of the dot-com bubble. Burry questions Federal Reserve Chair Jerome Powell's view that such spending is justified by current company earnings.

Key Facts

- Michael Burry is warning about a possible bubble formed by AI investments.

- He is known for predicting the 2008 housing market collapse.

- Burry compares current AI investments to the overbuilding during the dot-com bubble.

- Large companies like Microsoft and Google are heavily investing in AI.

- Burry believes Federal Reserve Chair Jerome Powell underestimates the risk of this bubble.

- Nvidia, a major tech company, is highlighted as being central to this issue.

- Nvidia recently reported a 62% earnings increase for a three-month period.

- Some experts have mixed views on whether a serious AI investment correction is looming.