Summary

People in north-east England are facing mental health problems due to stress from personal debt. According to local reports, high living costs and insufficient control over finances are major reasons for this debt. Many individuals, advised by debt charities, are working multiple jobs to afford basic needs.

Key Facts

- Citizens Advice reports north-east England has the second highest need for debt help in the UK.

- Debt charity StepChange found 37 clients per 10,000 adults in the North East in 2024.

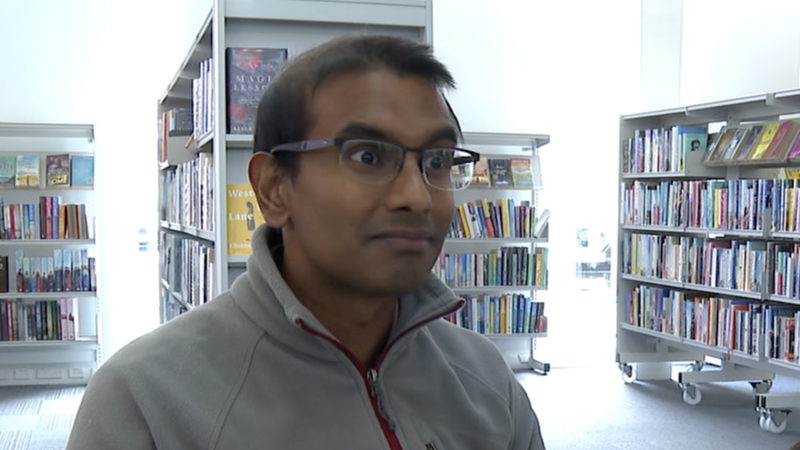

- Dr. Kamlesh Sreekissoon, a GP, observes patients working several jobs to manage debt.

- High living costs and lack of financial control are main debt causes, with local numbers surpassing UK averages.

- Many people are going into debt to cover essentials like food and fuel, not luxury items.

- Stress from debt is worsened by family and caregiving responsibilities, affecting mental health.