Summary

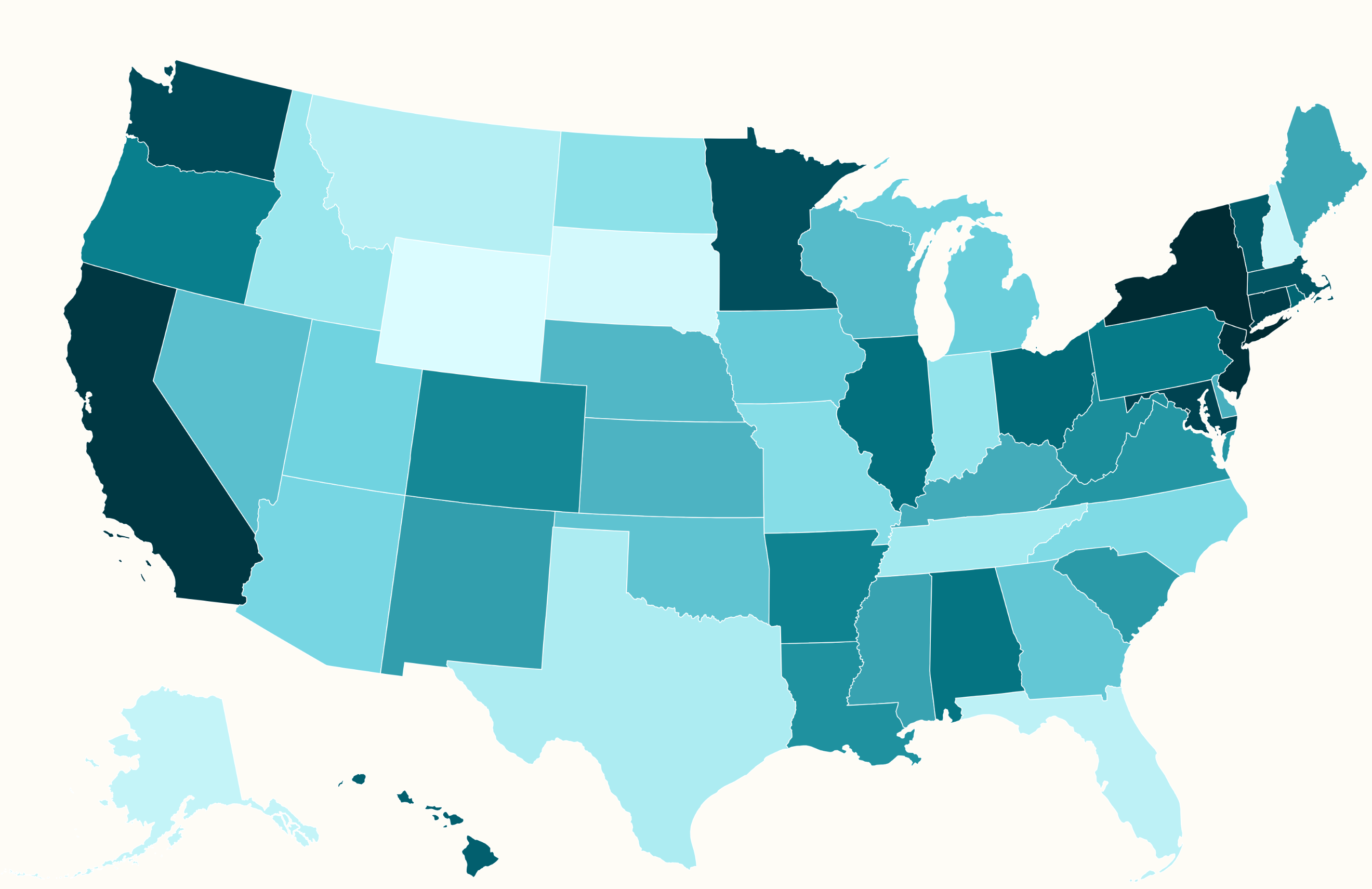

The 2026 State Tax Competitiveness Index by the Tax Foundation ranks U.S. states based on their tax systems, highlighting which states have the most business-friendly structures. Wyoming ranks highest due to not having individual or corporate income taxes, whereas New York ranks lowest for having high tax rates.

Key Facts

- The Tax Foundation released its 2026 State Tax Competitiveness Index.

- The index evaluates state tax systems based on over 150 variables, including corporate and income taxes.

- Wyoming ranks highest because it has no individual or corporate income taxes.

- New York ranks lowest due to high rates of individual and corporate income taxes.

- The index does not account for public service quality funded by taxes.

- The report is designed as a tool for policymakers to compare tax burdens among states.

- South Dakota also ranks highly, like Wyoming, for not having income taxes.

- The lowest-ranking states include New York, New Jersey, and California, which have complex and high-rate tax systems.