Summary

Washington state is considering a new tax plan that would impose a 9.9% tax on incomes over $1 million. The proposed "millionaire tax" aims to shift the tax burden to high earners and support lower-income residents. This measure would make Washington one of several states with similar taxes targeting the wealthiest citizens.

Key Facts

- Washington state is debating a new tax on incomes over $1 million.

- The proposed tax rate would be 9.9% on high earners.

- Governor Bob Ferguson supports the proposal, which intends to ease the tax burden on lower-income people.

- If approved, the tax would not take effect until 2029.

- Washington currently does not have a personal income tax.

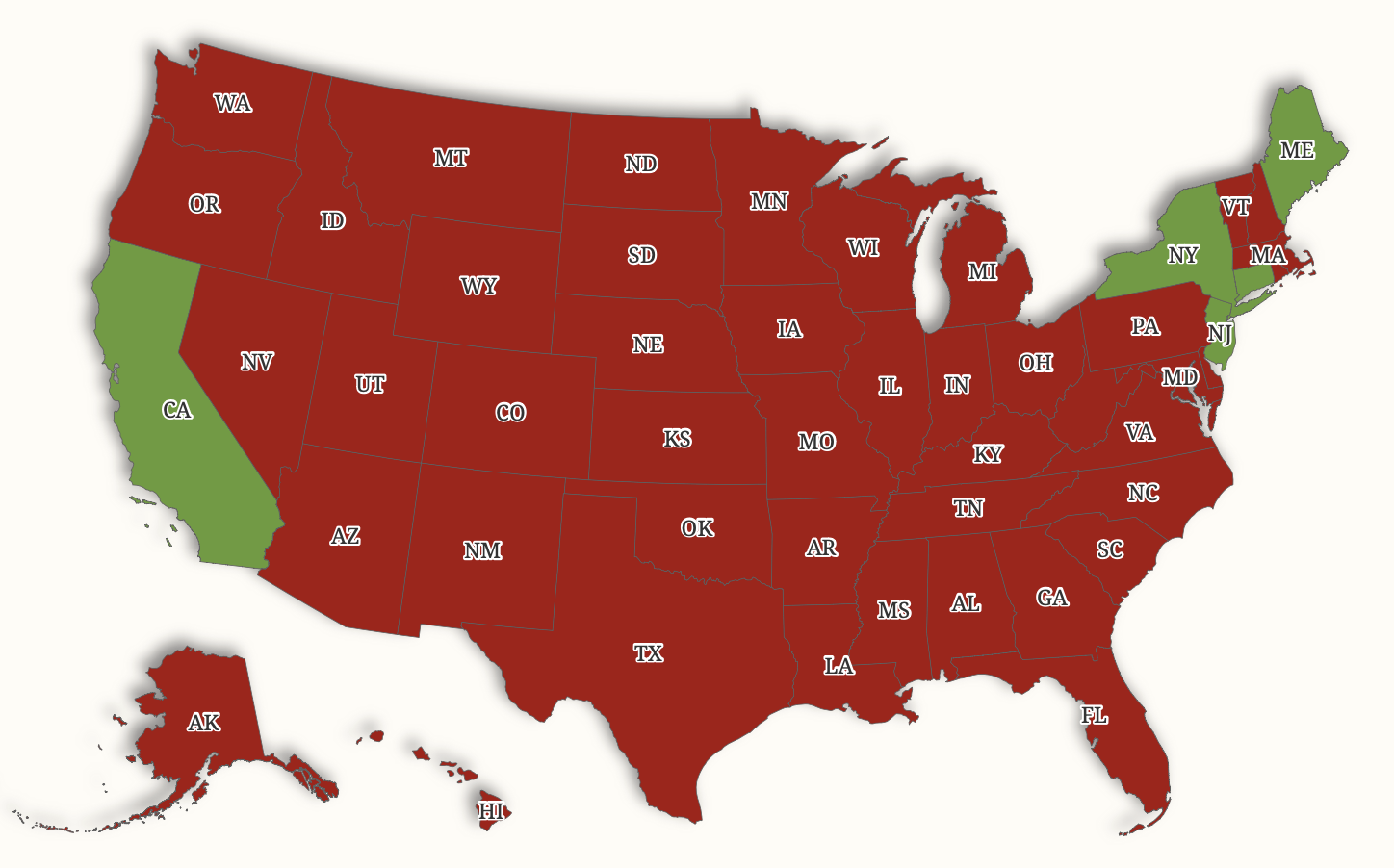

- Other states with similar millionaire taxes include California, Connecticut, Maine, New Jersey, and New York, among others.

- At the federal level, there is no separate millionaire tax; the highest income tax rate is 37% for incomes above $609,351.