Summary

The United States has avoided a new global tax rule that sets a 15% minimum for corporate taxes. This exemption is seen by the U.S. as a win for its independence and for protecting American businesses. The rule was part of a large agreement made by 147 countries to bring consistency to international taxes.

Key Facts

- The U.S. announced it escaped a global directive for a minimum corporate tax.

- The global tax rule aimed to prevent profit shifting to low-tax areas.

- 147 countries, led by the OECD, agreed on this global tax plan.

- The U.S. exemption is from a 15% minimum global corporate tax.

- U.S. officials view this as a victory for U.S. sovereignty.

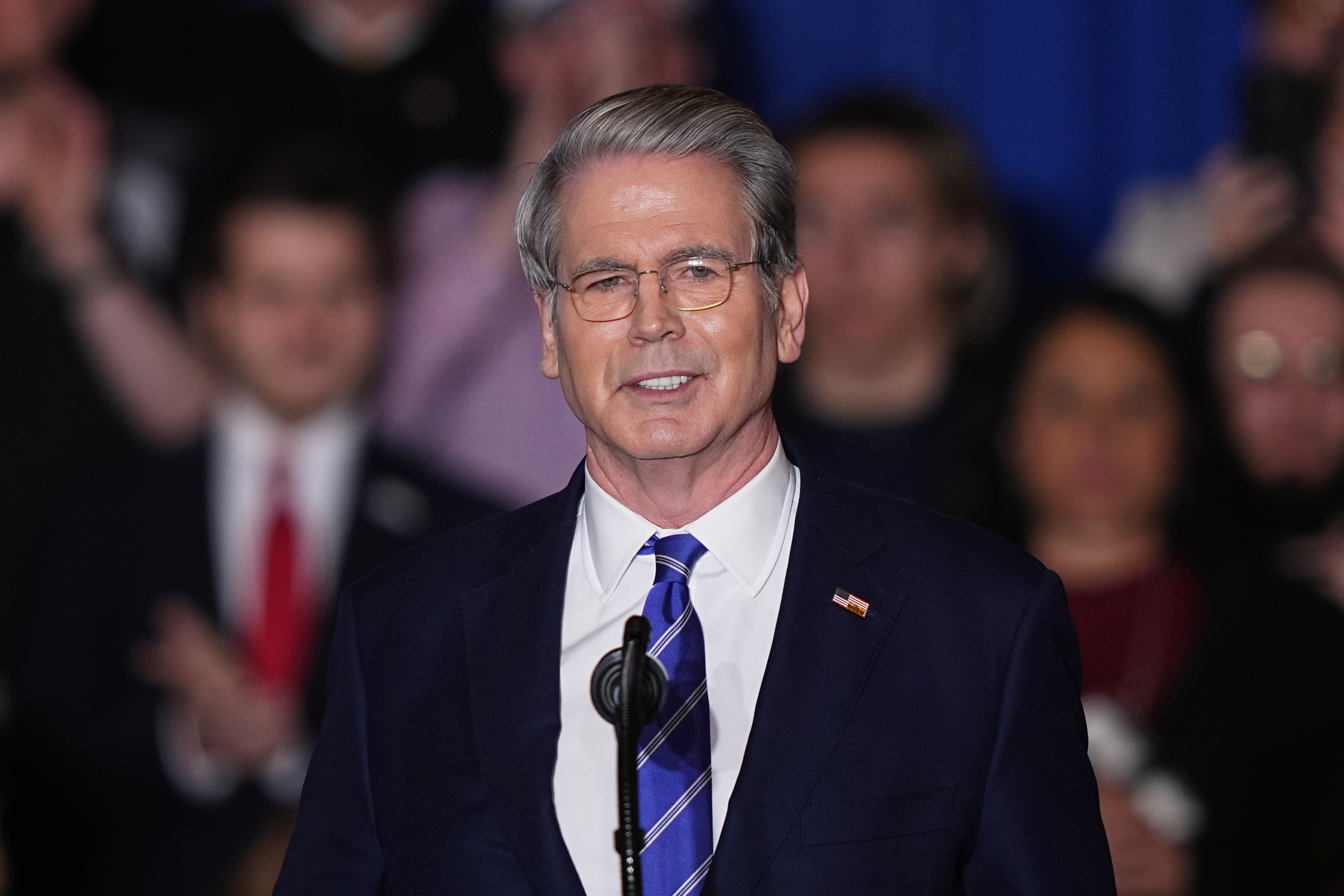

- Treasury Secretary Scott Bessent highlighted the importance of protecting American businesses.

- The U.S. plans to continue discussions on international tax rules, including those affecting digital businesses.