Summary

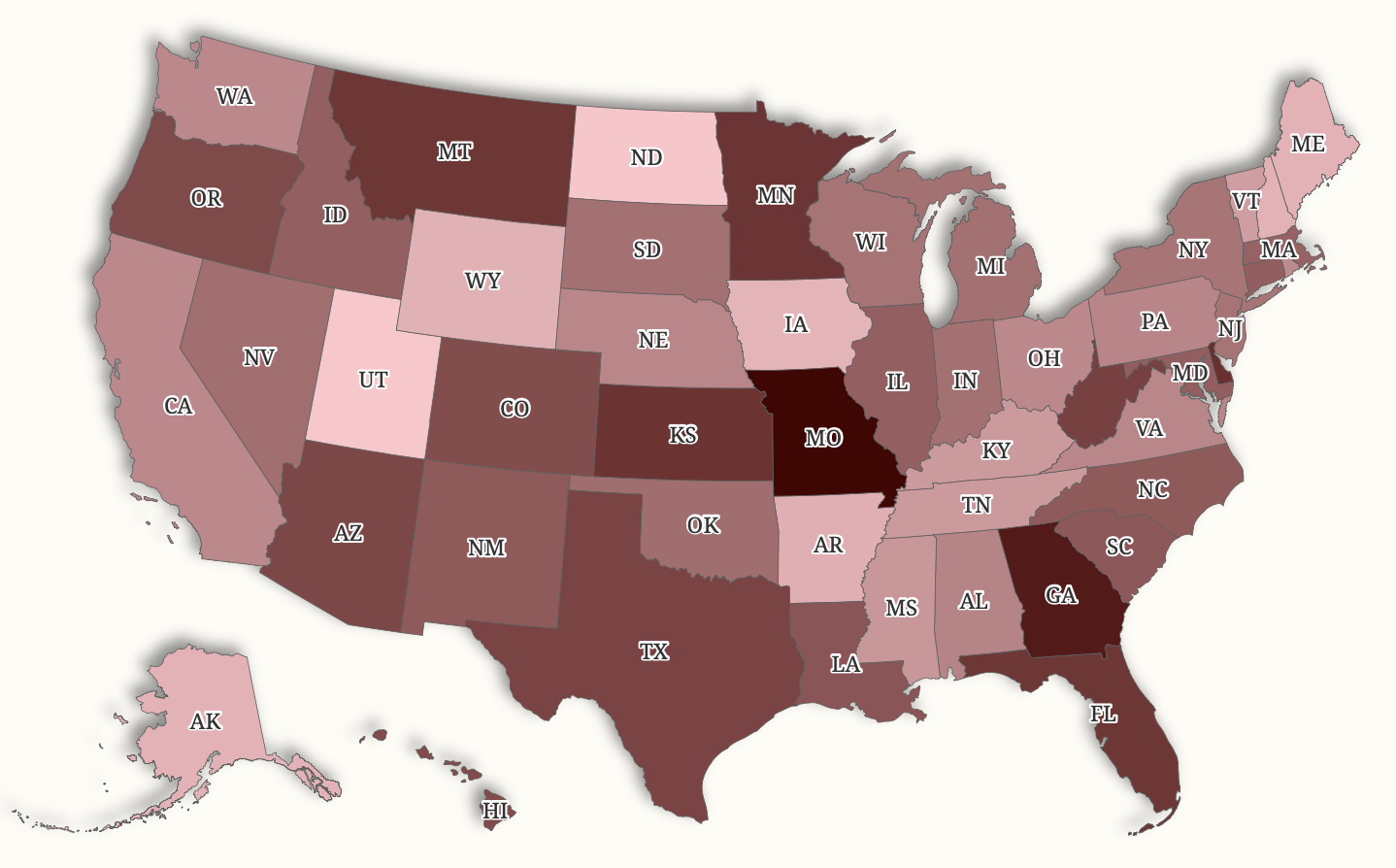

New data shows credit scores have dropped in every U.S. state over the past year, indicating financial struggles for many people. States like Missouri, Georgia, and Delaware experienced the biggest declines, partly due to missed payments and increasing debt levels. President Donald Trump has suggested a cap on credit card interest rates to help consumers.

Key Facts

- Average credit scores fell in all 50 U.S. states between 2024 and 2025.

- Lower credit scores can make borrowing money more costly.

- Credit scores depend on payment history and credit usage.

- About 74% of Americans have at least one credit card.

- Credit card interest rates are above 20%, making debt more expensive.

- President Trump proposed a 10% cap on credit card interest rates.

- Missouri saw the largest drop, with scores falling from 664 to 654.

- Georgia and Delaware also had significant declines in credit scores.