Summary

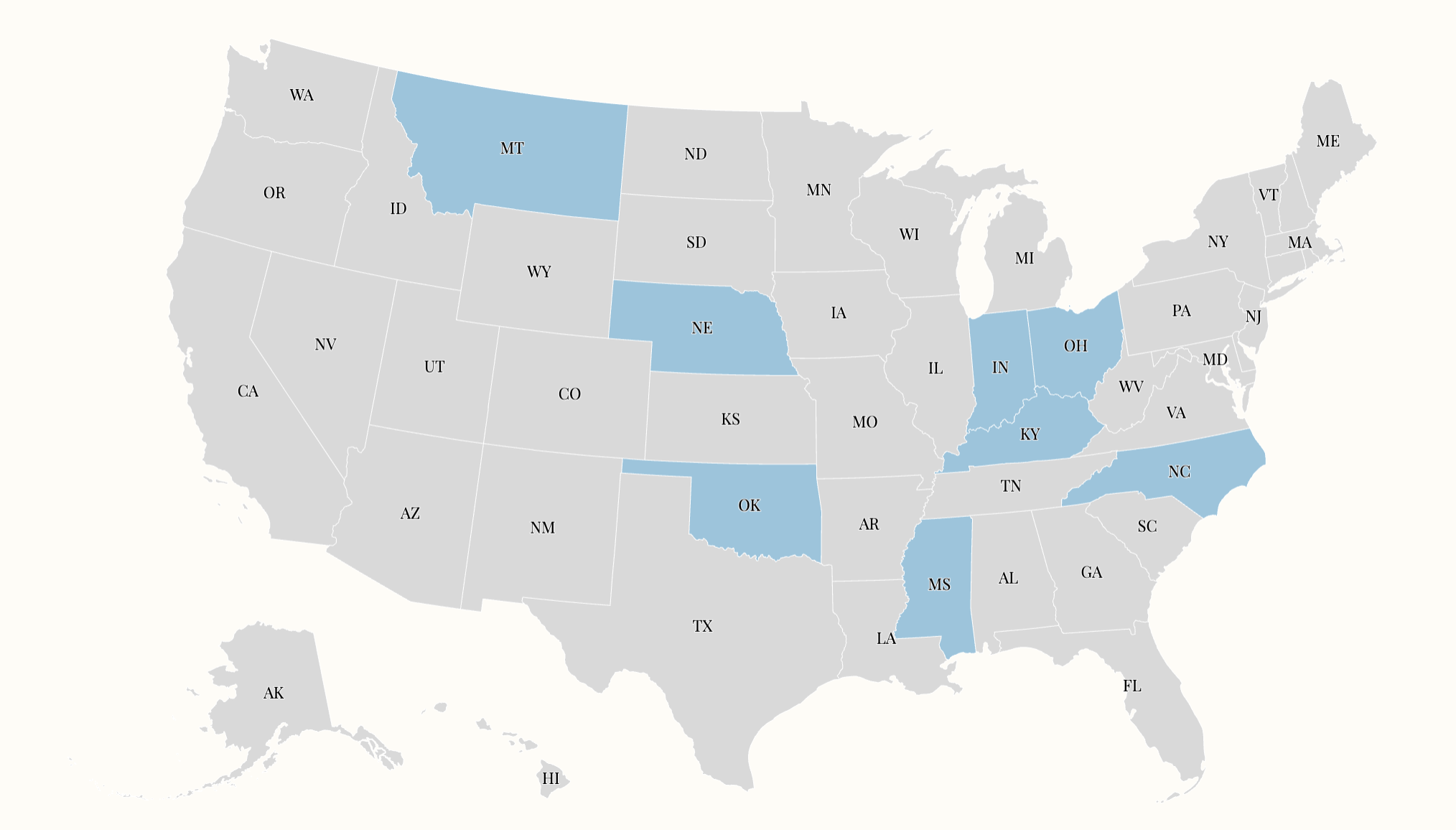

Eight U.S. states reduced their income tax rates starting January 1, in efforts to boost their economies. The changes aim to make these states more appealing to investors and attract job seekers. States like Indiana, Kentucky, Mississippi, and others adjusted their tax rates, some shifting to single-rate systems or continuing planned reductions.

Key Facts

- Eight states lowered their income tax rates as of January 1.

- The states are Indiana, Kentucky, Mississippi, Montana, Nebraska, North Carolina, Ohio, and Oklahoma.

- Ohio moved to a single-rate income tax system at 2.75%.

- Oklahoma reduced its tax brackets from six to three and lowered the top rate to 4.5%.

- Indiana's flat rate dropped from 3% to 2.95%, with plans to further reduce to 2.9% by 2027.

- Kentucky lowered its flat rate to 3.5% from 4%.

- Mississippi completed a phased reduction to a flat rate of 4%.

- Montana's top rate dropped to 5.65%, with plans to reduce to 5.4% by 2027.

- The Center on Budget and Policy Priorities expressed concerns about large tax cuts and their impact on communities.